Week Five- The Mortgage Products

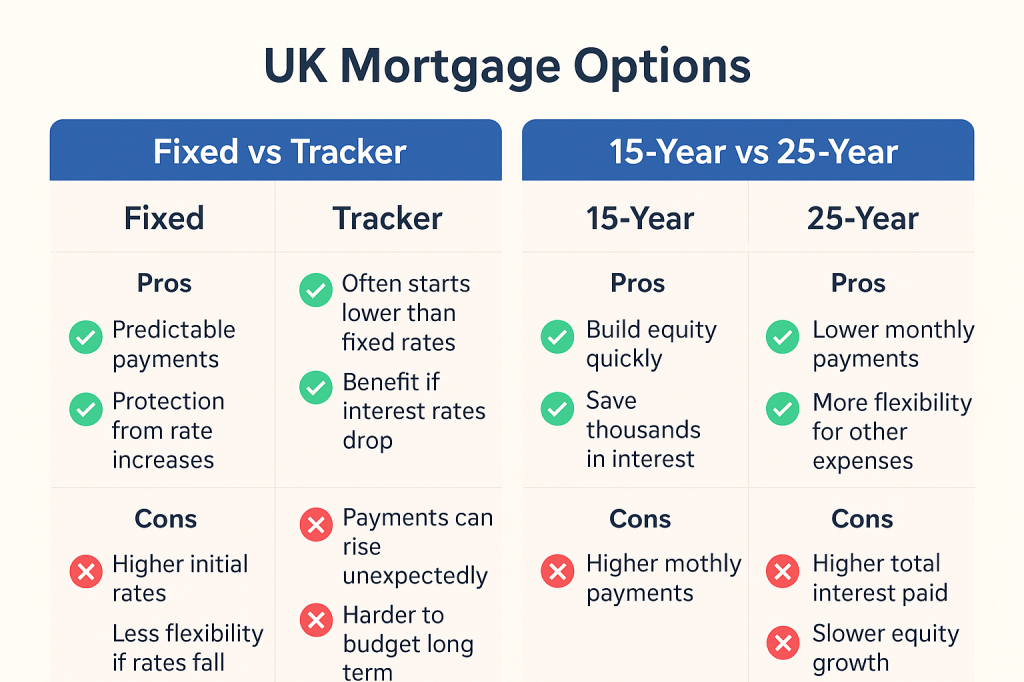

Buying your first home in the UK can feel like navigating a maze of jargon. Fixed-rate, tracker, 25-year, 15-year—it’s enough to make anyone’s head spin. Let’s break it down in simple terms so you can make informed decisions in 2026.

Understanding Mortgage Types

Fixed-Rate Mortgages

A fixed-rate mortgage means your interest rate stays the same for a set period, usually 2, 3, 5, or 10 years. After this period, your rate may revert to the lender’s standard variable rate (SVR).

Pros:

- Predictable monthly payments

- Protection from interest rate increases

Cons:

- Initial rates can be higher than tracker mortgages

- Less flexibility if rates fall

Tracker Mortgages

A tracker mortgage follows the Bank of England base rate, plus a set margin. If the base rate changes, your payments move up or down.

Pros:

- Often starts lower than fixed rates

- You benefit if interest rates drop

Cons:

- Payments can rise unexpectedly

- Harder to budget long-term

Discount and Variable Rate Mortgages

Some lenders offer discounts off their SVR for an introductory period. After that, rates may rise. These are similar to trackers but can be less predictable.

Choosing a Term: 25-Year vs 15-Year Mortgages

25-Year Mortgage

The most common mortgage length in the UK. You pay less each month, but more interest overall.

Pros:

- Lower monthly payments

- More flexibility for other expenses

Cons:

- Higher total interest paid

- Slower equity growth

15-Year Mortgage

You’ll pay off your home faster, with higher monthly payments but less interest overall.

Pros:

- Build equity more quickly

- Save thousands in interest

Cons:

- Higher monthly outgoings

- Less room for other financial commitments

Interest Rate Trends & What Matters for 2026 Approvals

UK mortgage rates are influenced by the Bank of England base rate and broader economic conditions. In 2026, lenders will scrutinise your financial health more than ever.

Key Tips:

- Keep your debt manageable

- A larger deposit (20% or more) can reduce rates and eliminate the need for mortgage insurance

Choosing Based on Your Financial Personality

Your mortgage should suit your lifestyle and financial habits:

- Cautious Planner: Prefer stability? A fixed-rate mortgage for 2–10 years gives predictability.

- Flexible Risk-Taker: Can handle changes in rates? A tracker mortgage could save money upfront.

- Debt-Slayer: Want to clear your mortgage quickly? Opt for a 15-year fixed term.

- Budget-Conscious: Unsure of your future plans? A longer term like 25 years keeps monthly payments manageable.

Bottom Line

There’s no one-size-fits-all mortgage. In 2026, the right choice balances your monthly budget, long-term goals, and tolerance for risk. Being informed, planning ahead, and understanding UK-specific mortgage products will make the journey smoother.